A federal court has accused a former Richmond credit union manager of two counts of bank fraud, and he’s agreed to plead guilty, according to court documents.

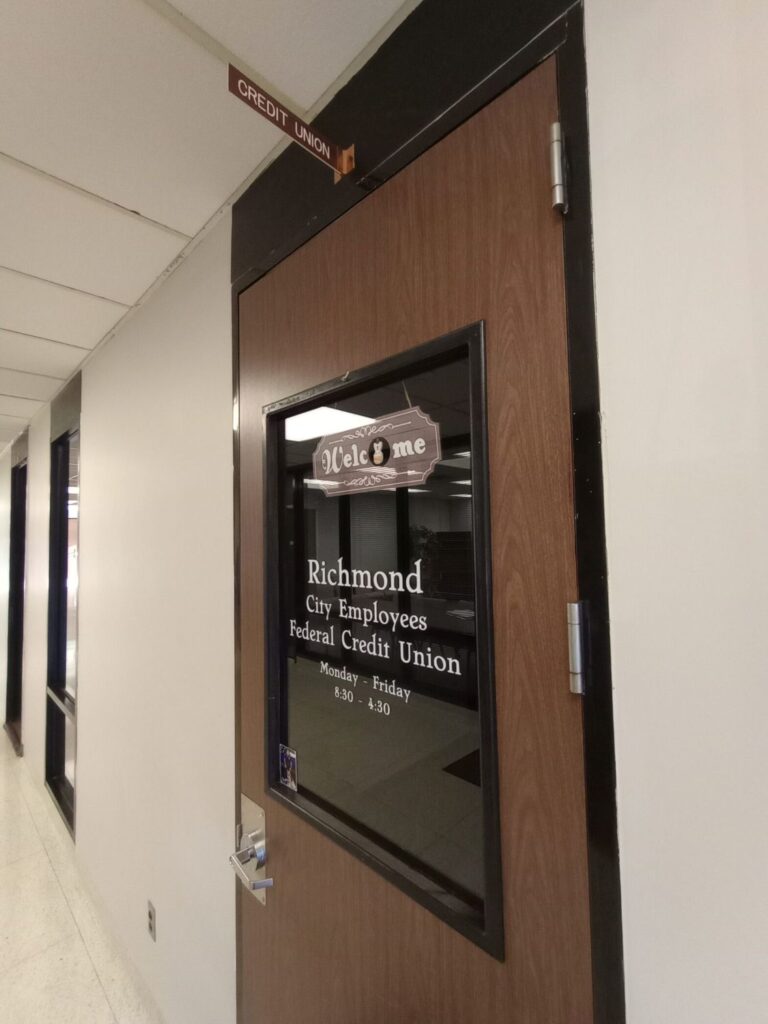

Daniel Johnson was the chief executive officer/manager of what was known as Richmond City Employees Federal Credit Union.

The credit union began serving workers in city government, Morrisson-Reeves Library and General Telephone Company and their families in 1961.

National Credit Union Administration announced in December 2022 that the agency would temporarily manage the credit union, called conservatorship, to protect members’ assets because of “unsafe and unsound practices.”

In April 2023, NCUA announced RCEFCU would merge with Kemba Credit Union. In a news release at that time, NCUA officials said they worked to address “issues affecting the credit union’s safety and soundness” and determined the merger was in members’ best interests.

Kemba stands for Kroger Employees Mutual Benefit Association. It’s based near Cincinnati, Ohio, where the supermarket chain’s corporate headquarters are located.

Court documents

The charges against Johnson, plus a petition to enter a guilty plea and a plea agreement, were filed March 14 in U.S. District Court for the Southern District of Indiana.

Court documents signed by former U.S. Attorney Zachary Myers allege that in August and September 2021, Johnson created two additional accounts for DAJ Consolidated and Daniel A Johnson that ended with different numbers than his own account.

Because he was the manager, Johnson was to have any loan approved by the credit union’s board.

Johnson obtained unsecured loans totaling about $300,000 to buy two Winnebago recreational vehicles, Myers said.

However, Myers said Johnson had no intention to buy those vehicles and instead transferred those funds to his personal checking account to pay off his home mortgage, cover credit card and student loan debt, and make debit card purchases.

On the second loan, Johnson forged the signature of his then-wife, Myers said.

In total, the credit union lost about $275,000, Myers said.

The federal government is seeking repayment of $285,855.66.

Johnson faces maximum penalties for each charge of 30 years in prison, three years of supervised release, and a fine of $250,000 or twice the gross gain or loss caused by the offense, whichever is greater.

Johnson is scheduled for an initial appearance March 26 at the U.S. Courthouse in Indianapolis.

A version of this article appeared in the March 26 2025 print edition of the Western Wayne News.