Centerville-Abington Community Schools conducted a preliminary hearing July 10 regarding financing to demolish its annex building and former administration office and to cover technology expenses.

School officials closed the annex, where older Centerville-Abington Elementary students attended after new classrooms were added to the school building.

Some board members had favored restoring the annex until learning the addition would be much less costly than making repairs and meeting current building codes.

Centerville schools made the annex available for a charter school to buy as required by state law, but no offers were made.

Centerville town officials have condemned both the annex and the old administration office, which has no plumbing or electricity. Annex demolition is expected to cost about $600,000. Because of mold concerns and proximity to the current administration building, the office isn’t suitable for fire training.

The district is also short $170,000 for technology needs because Indiana didn’t offer loans last year as expected.

Baker Tilly Municipal Advisors presented a plan for borrowing up to $2,180,000 with a conservative estimated interest expense of $371,812 for repayment in five years and three months.

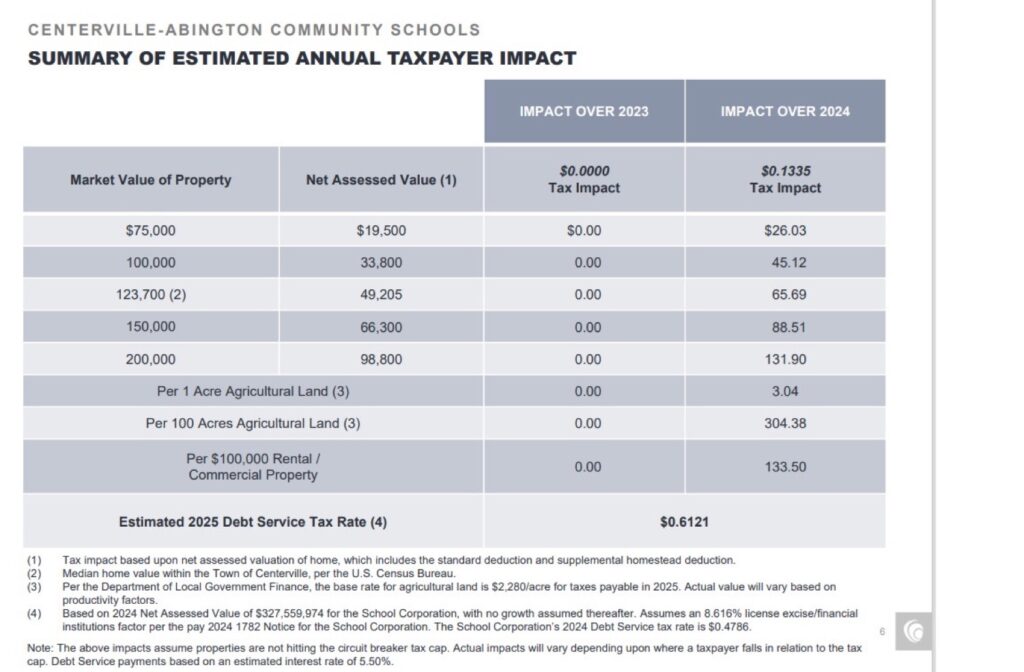

The 2025 debt service tax rate would be $0.6121, about the same as in recent years. The tax rate unexpectedly decreased this year.

On properties that aren’t already hitting the circuit breaker tax cap, homeowners would pay $0.1335 more in taxes starting in 2025. A $100,000 owner-occupied home would cost $45.12 more annually; each $100,000 in rental/commercial property is $133.50 more. Farmland would be $3.04 more per acre.

A second public hearing will be conducted at the board’s regularly scheduled meeting at 7 p.m. July 24 in the administration building, 115 W. South St., Centerville. The public may attend.

A version of this article appeared in the July 17 2024 print edition of the Western Wayne News.