Would your property sell for the assessed value?

That’s what Wayne County Assessor Tim Smith asks property owners wondering about their annual assessments. Indiana expects local assessments to reflect the local market values, Smith said.

“Our goal is to be as accurate as possible and to be fair and equitable with everyone else,” Smith said.

Form 11s notifying county property owners about their 2025 assessments had to be mailed by April 30. That meant the envelopes arrived in county mailboxes during the early days of May. When property owners opened those envelopes, many felt angst. The average Wayne County assessment rose 15% from 2024.

Smith cites a couple of reasons for the increase. First, the state increased its cost tables by 30 to 35% across the board. The cost tables include the “sticks and bricks,” Smith said, rising as inflation increases the cost of goods.

Then, the Department of Local Government Finance must approve the county’s ratio study that compares assessments with actual sale prices. Smith said that 2024 assessments for properties sold were about 78% of those properties’ sale prices.

Smith said assessments probably should have gone up more two years ago than they did. He hedged, however, to see if the real estate market slowed during 2024. It didn’t, so the 2025 assessments needed to rise.

“This year, there was no way not to increase them based on what the data was telling us,” Smith said.

Still, after Smith applied the state cost tables, he pulled back the values as close to 2024 as possible and used the sale price trend. That provided numbers the state approved.

Assessments increased even though property owners made no improvements. Smith said that 20 years ago, the idea that there shouldn’t be an increase without improvements was correct. Now, the assessments move up to better reflect market value.

Also, Smith feared property owners would assume that because state legislators were promising property tax relief, the county boosted assessments to offset that relief. He said that’s not true and reiterated that the assessments were based on the data.

Local governments still don’t know how the legislature’s actions will impact property taxes residents pay during 2026. Property tax rates fall as assessments rise, but state changes in deductions and credits also influence tax bills.

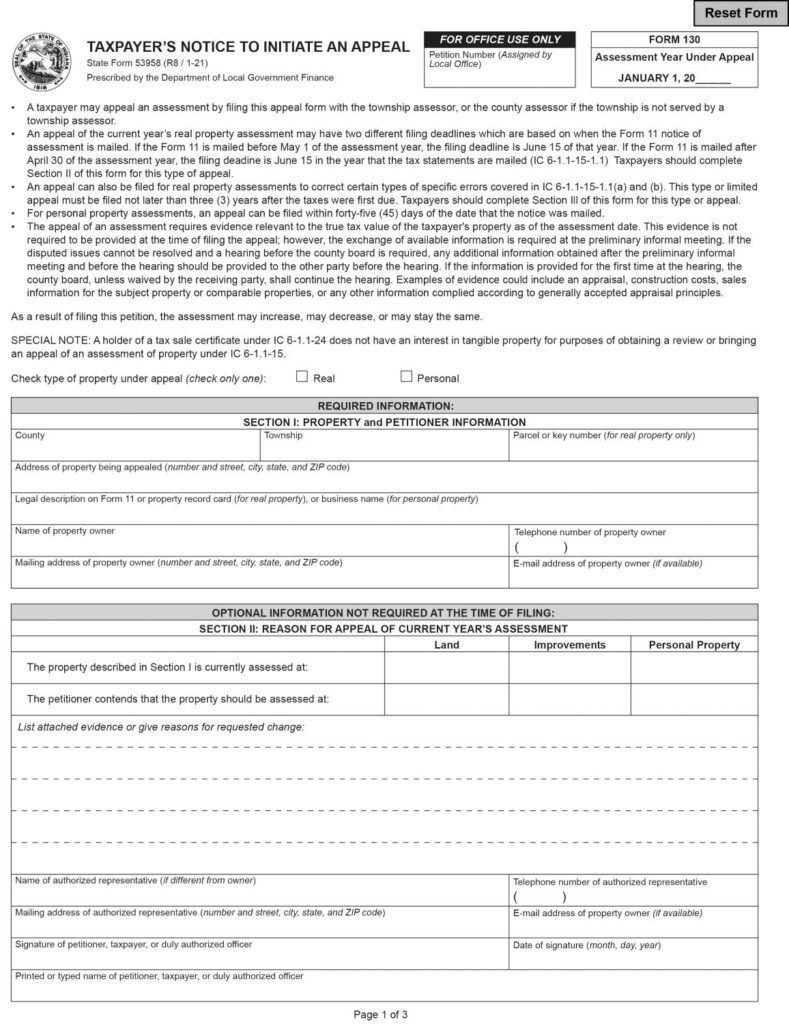

Property owners who think their assessments are unfairly high have until June 16 to appeal. Initiating an appeal will result in the assessor’s office looking individually at a property, rather than relying on the mass assessment.

To initiate an appeal, property owners can scan the QR codes on their Form 11s to access a website where an appeal may be initiated online. They can also go to the Department of Local Government Finance website to download Form 130. Or, property owners may visit the assessor’s office on the lower level of the of the Wayne County Administration Building, 301 E. Main St., Richmond, to fill out an appeal form.

A version of this article appeared in the May 14 2025 print edition of the Western Wayne News.