The city of Richmond scrimped and saved this year, aiming not to spend all of its appropriated money.

Mayor Ron Oler expects that more than $3 million will remain unspent, predominantly from open police and fire positions, and he plans to use most of that to fully fund the 2026 budget. The budget presented to Richmond Common Council across three nights Sept. 22-24 exceeds expected revenue by $2,344,468.85.

“There is no place to eliminate another two-and-a-half-million dollars,” Oler said, “but through unfilled positions now, we’re looking at an ending balance in 2025 of $3 million, so that’s where it will come from.”

Council scheduled a special meeting for Sept. 29 to officially receive the budget and salary ordinances. The public hearings for those ordinances will be 7 p.m. Oct. 6 in the council chambers at 50 N. Fifth St., Richmond, with budget adoption scheduled for 7 p.m. Oct. 20.

The city’s complete advertised budget is available on the Department of Local Government Finance’s website at wwn.to/richmondbudget26. Whitewater Community Television’s videos of the three council Committee of the Whole budget hearings are available on YouTube at youtu.be/ycojZ3rr7xU, youtu.be/R4xceJVZYzI and youtu.be/xqoGQ0Sq_7E.

Since the city’s budgeting process began in April, Oler said department heads have explored all avenues for savings. The advertised general fund budget is $27,706,236 of the total $65,084,602 advertised city budget.

“We’re looking under every rug and doormat to find savings wherever we can,” Oler said.

The citywide payroll will increase from $20.09 million this year to $22.57 million in 2026, Oler said, because of increases negotiated into union contracts. There will not be raises for elected officials or nonunion employees for 2026.

Increased union wages account for the budget’s unfunded portion. For example, firefighters will receive a 4.5% wage increase that will cost the city an extra $955,640, while the city’s police officers continue negotiations for their new contract.

The city’s advertised maximum levy is $25,230,500. Property tax rates will provide that revenue, although Oler said property tax caps will reduce the city’s revenue by $5.9 million, increasing the total lost to more than $120 million since property tax reforms were implemented in 2010. That’s challenged city budgets, causing staffing reductions, deferred maintenance and fewer pay increases for nonunion employees, Oler said.

The city divides levy money among its taxing funds, which include the general fund, fire pension fund, police pension fund, motor vehicle highway fund, parks and recreation fund, and cumulative capital development fund.

For 2026, the city is adding $300,000 from the levy to the parks department’s budget, trimming the police and fire pension funds by $150,000 each. Tracy McGinnis, the city controller, said both funds are well-positioned for the decreased allocations and would still add to their cash balances by the end of 2026.

Denise Retz, the parks superintendent, said deferred maintenance because of the parks department’s property tax allocation has proved challenging. In 2026, the department plans to improve Glen Miller Park, which Retz said has the potential to be one of the region’s best parks.

Council member Jerry Purcell questioned providing the extra allocation to parks, saying he’s philosophically opposed. The city loses police officers and firefighters to other departments that pay more, he said, and that $300,000 could provide bonuses as incentives for them to remain in Richmond. It doesn’t make sense to spend it on parks, Purcell said.

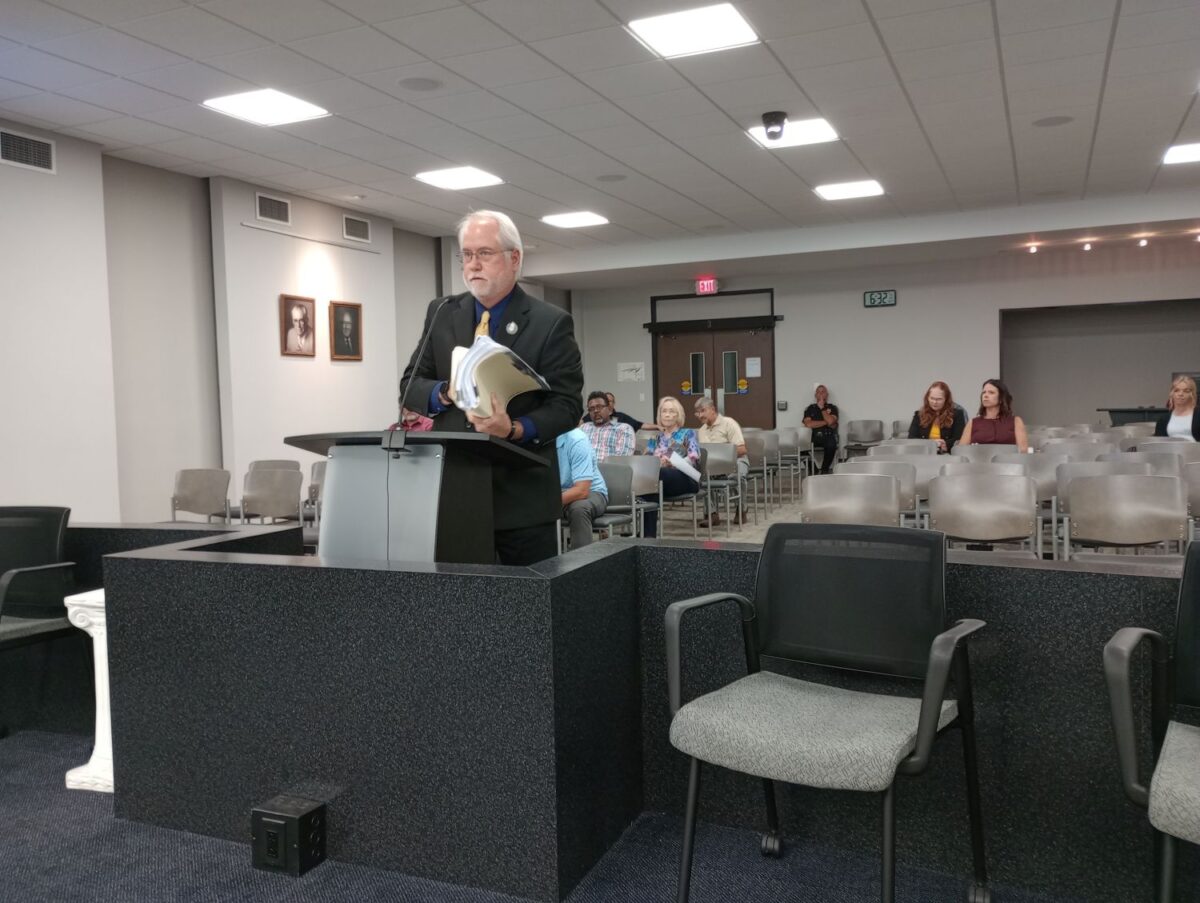

Oler showed council members a thick folder filled with papers reflecting the state legislature’s changes that impacted budgeting this year. He said changes that increase revenue could not be factored into the budget because the amounts are merely projections. Oler said he expects the city to receive about $600,000 from the local option highway user taxes enacted by Wayne County Council. The city’s share of Indiana’s cigarette tax should also increase, because the state legislature increased the tax by $2 per pack beginning July 1. The state collected $50 million in August, Oler said, which is a 174% increase from the same month last year.

As the city battles budget issues now, Oler said it must hang on into 2027. That year, the local income tax structure changes, eliminating current taxes and forcing entities to implement new taxes. The changes provide the city opportunities to enact income taxes itself, rather than relying on county government’s actions. For example, the city will have the option of enacting a local income tax to provide public safety funds.

“We will control our own destiny starting in ’28 in those areas,” Oler said. “Right now we can’t.”

A version of this article appeared in the October 1 2025 print edition of the Western Wayne News.